Here’s Where Expedia’s Share Price Is Likely To Travel To Next

Goodfellow LLC is an outperforming growth stock website. Crista Huff makes stock recommendations based on strict fundamental & technical criteria, designed to maximize growth while minimizing risk. Investors subscribe to Goodfellow LLC in order to follow Ms. Huff’s recommendations and improve their stock portfolio returns.

Eight of the ten Goodfellow LLC stock portfolios from 2012-2014 outperformed

the U.S. stock market indices by 50-100% and more.

* * * * *

(EXPE, $78.08, down $9.92 midday)

Shares of global online travel company Expedia, Inc. are down 11% today on a big earnings miss, caused by adverse foreign currency effects. While the earnings miss was somewhat significant, investors should also be aware that in recent weeks, corporate earnings reports are being met with exaggerated price volatility. In my opinion, Expedia’s share price drop today was somewhat ridiculous.

Excluding currencies, fourth quarter revenues and gross bookings rose 27%. Detrimental foreign exchange conditions are also expected to impact full-year 2015 revenues.

Expedia’s investment in Chinese travel company eLong met with a greater quarterly loss than expected, with revenues coming in 10% below consensus estimates.

Total quarterly earnings per share (EPS) were $0.86 vs. $0.92 last year; while the market expected $1.01.

Sign up for my free, weekly newsletter. ——— >>>

EARNINGS OUTLOOK

Wall Street analysts have recently been increasing their 2015 earnings estimates for Expedia, expecting EPS to grow 17.2, 15.5%, and 15.1% in 2015 through 2017 (December year-end). Investors should expect the 2015 number to ratchet downward as analysts’ adjust their full-year estimates in light of the ongoing currency impact.

Earnings growth remains very attractive. However, the 2015 PE is 16.8, vs. the projected 2015 EPS growth rate of 17.2%, representing a currently-fair stock valuation.

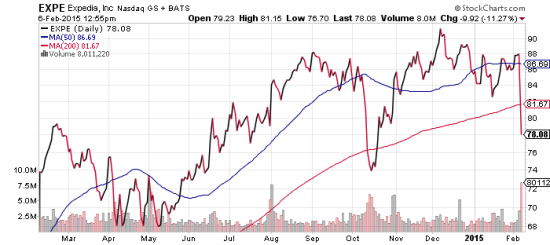

CHART OUTLOOK

The stock rose to $88/$89 in late August 2014, corrected with the broader market in October, then rebounded back to upside price resistance by mid-November.

I was cautious on EXPE shares in late 2014, due to its much higher PE.

On November 26th, when the price was $86, I said, “At this point, I expect the stock to trade between $82-$89 in the near-term. There is a decent chance that the stock could surge upward to new highs. If that happens, shareholders should be grateful for the unwarranted gains, and use stop-loss orders to protect capital.”

The share price proceeded to climb, briefly reaching a new high of $92.08 nine days later, then fell back into that $82-$89 trading range, bouncing at $82 on January 16th, and above $88 in recent days.

Now that the stock price has fallen below support, into the upper $70’s, the most likely near-term scenario is that EXPE will trade between $79-$84 for a while. However, it is too soon to make a decisive prediction. Be cautious.

RECOMMENDATION

Buy-and-hold investors should hold their shares, because Expedia is projected to continue to have strong earnings growth.

Lacking a well-defined trading range, traders should avoid EXPE.

Growth stock investors should have been using stop-loss orders. The chart is too weak now for a quick rebound toward recent highs. If you still own the stock, consider selling on an upward bounce around $83.50. At that point, put your capital into a more undervalued growth stock, with a more bullish chart.

Goodfellow LLC rating: Growth, Volatile, Public. (02-06-15)

EXPE shares appeared in the Goodfellow Growth Stock Portfolio for 2014, and rose 22.54% plus dividends.

Chart courtesy of StockCharts.com.

* * * * *

Subscribe now for a one-week trial,

and let Goodfellow LLC help increase your capital gains potential.

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply